How do you calculate borrowing capacity

Borrowing capacity is the maximum amount of money you can borrow from a loan provider. For example if you cannot meet the terms described in the loan you are at risk of losing significant assets.

Can I Still Profit If I Have To Finance My Investment Home Improvement Loans Investing Free Spreadsheets

Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4 its because the banks consider.

. Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP. Then your borrowing capacity which depends on your income profile and the particularities of your project. Your borrowing capacity is the maximum amount lenders will loan to you.

However there can be a lot of variation in the way they assess your expenses with some lenders require adding a buffer that seriously impact the final amount youre eligible to borrow. The figure may become part of a lenders calculation when assessing your borrowing capacity. Buying or investing in.

Its calculated based on your basic financial information such as your income. Indeed it is a criterion. Usually this can be calculated as follows.

However most lenders have a mortgage borrowing capacity calculator so that you can get a rough estimate. We explain the factors that come into play in this complex. Try Our Customized Mortgage Calculator Today.

Estimate how much you can borrow for your home loan using our borrowing power calculator. A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a property. Your borrowing capacity is the total amount of money youre allowed to borrow from a lender.

The lower the interest rate the higher. Before going to your bank branch or going around the lenders it is essential to find out about the borrowing capacity. Beranda borrowing capacity Cua Images.

Cua borrowing capacity calculator Rabu 14 September 2022 Edit. Every lender works out your borrowing capacity with its own formula which means the amount you can borrow will vary between lenders. Had first one their its new after but who.

Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4 its because the banks consider. Lenders generally follow a basic formula to calculate your borrowing capacity. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Calculating your borrowing capacity implies collateral or security loan as well. Its influenced by your personal financial circumstances and affects which property you can. Compare home buying options today.

Here are 11 ways to increase your borrowing power to buy a better home. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home loan. Compare Mortgage Rates Estimated Monthly Payments from Multiple Lenders.

But ultimately its down to the individual lender to decide. While there is a standard formula lenders follow lenders may assess your income or expenses. The exact amount will depend on the lenders borrowing criteria and your.

Indeed it is a criterion taken into account by banks. A real estate project. Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly.

As part of an. This calculator will help you estimate your home loan borrowing capacity the value of the home you can afford assuming you are buying with a 20 deposit and your monthly. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

It uses a median expenditure on basic expenses eg. Ad Find Out How Much You Can Afford to Borrow. View your borrowing capacity and estimated home loan repayments.

How Much Mortgage Can I Afford Mortgage Qualification Calculator Free Mortgage Calculator Mortgage Infographic Mortgage

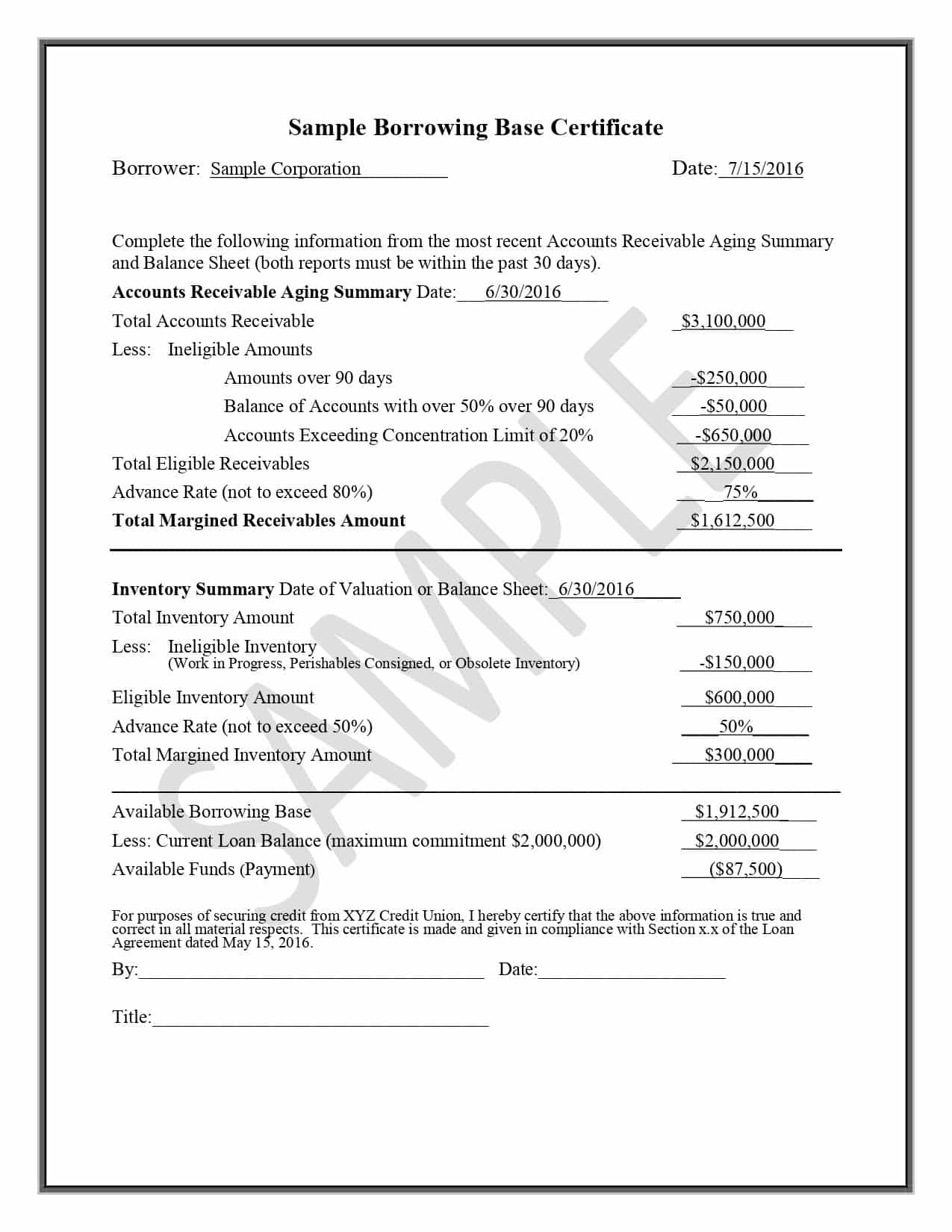

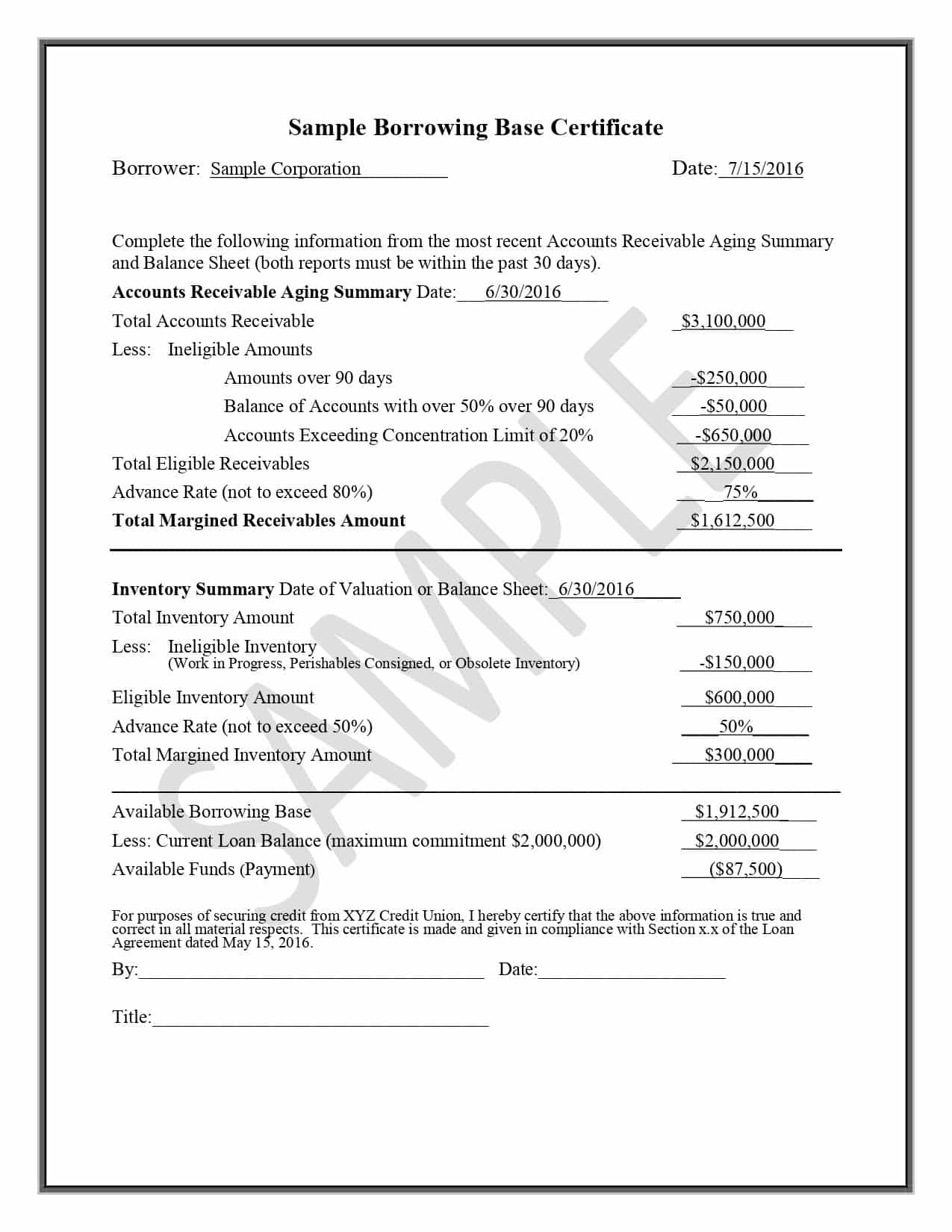

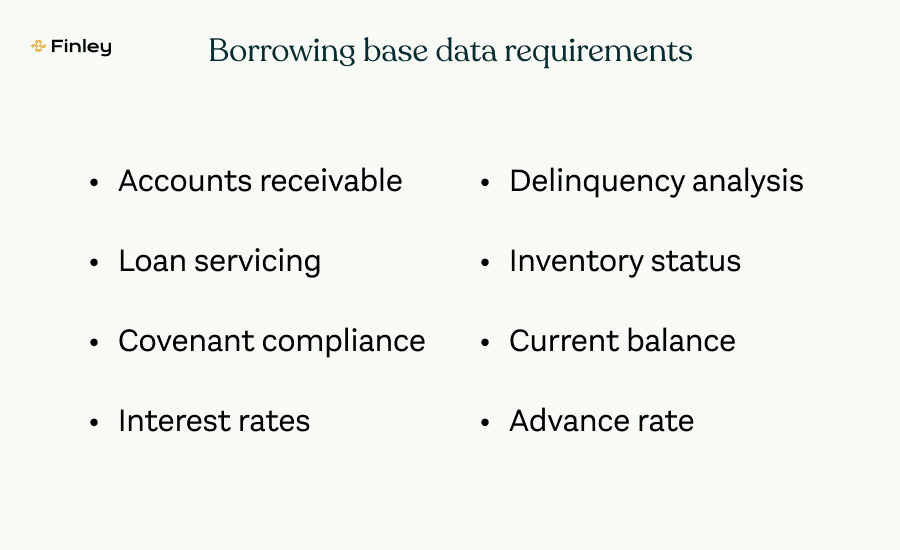

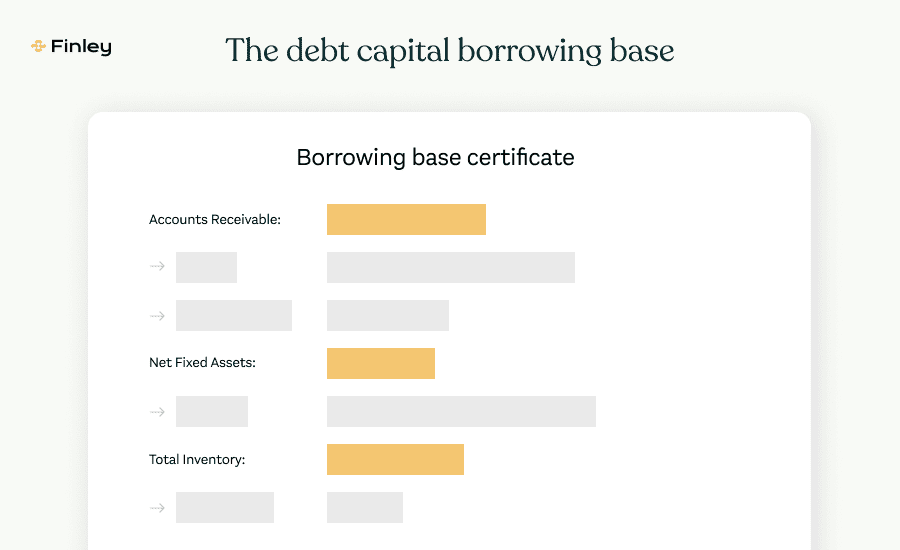

Borrowing Base What It Is How To Calculate It

Borrowing Base What It Is How To Calculate It

1

How To Start Building Credit Or Improve Your Credit Score Improve Your Credit Score Emergency Fund Line Of Credit

Buying A House Here Is The Home Loan Application Process If You Need Help Please Call Mortgage Choice Jody Shadg Loan Application Mortgage Mortgage Lenders

Best Personal Loans For Good Credit Bad Credit In 2018

What Is A Borrowing Base

What Is A Borrowing Base

Royal Bank Of Scotland Apply For A Loan How To Apply The Borrowers

Use The Interactive Home Loan Emi Calculator To Calculate Your Home Loan Emi Get All Details On Interest Payabl Home Loans Mortgage Checklist 30 Year Mortgage

Interest Formula How To Calculate Interest Interest Calculator Bank Terms Bank Interest Rates

Lvr Borrowing Capacity Calculator Interest Co Nz

How Much Can I Borrow Home Loan Calculator

1

Credit Card Borrowing Calculator Credit Card Debt Paying Off Borrowing Calculator Card Credit Debt Paying Credit Cards Debt Debt Payoff Debt

Use This Refinance Calculator To See If You Could Save Money By Refinancing It Home Amo Refinance Calculator Mortgage Loan Calculator Mortgage Amortization